Technical Analysis Course Details

| Details | Technical Analysis Course |

| Technical Analysis Course Fee | |

| Duration of Certificated Technical Analysis Course | 3 Weeks |

| Certifications | 1 Certificate of The Thought Tree |

| Technical Analysis Course Batch Strength | 7-8 |

| Fees Installment Facility for Technical Analysis Course | Available |

| Special Discount | 5% Additional Discount for Females |

| For More Details Contact | +91 9116134572 |

Note: Examination fee of NSE & SEBI certification is extra

Why you Should Choose The Thought Tree for Technical Analysis Course in India

About the Best Technical Analysis Course in Jaipur

The 3 Weeks stock market technical analysis course is one of the best trading courses offered by The Thought Tree. Under the Technical Analysis Course, students will learn about technical analysis from scratch. In the advanced technical analysis course, students will learn about the basics of technical analysis, candlestick patterns, risk management, indicators and oscillators, advanced technical analysis strategies, etc.

The Thought Tree provides mentorship under the stock market technical analysis course so that students don’t have any doubt in their minds. Students also get 1 Year Membership, 1 Certificate, and Live Trading Practice in the technical analysis trading course.

Reasons to Choose The Thought Tree?

Our Approach

Know Your Mentor

Testimonials

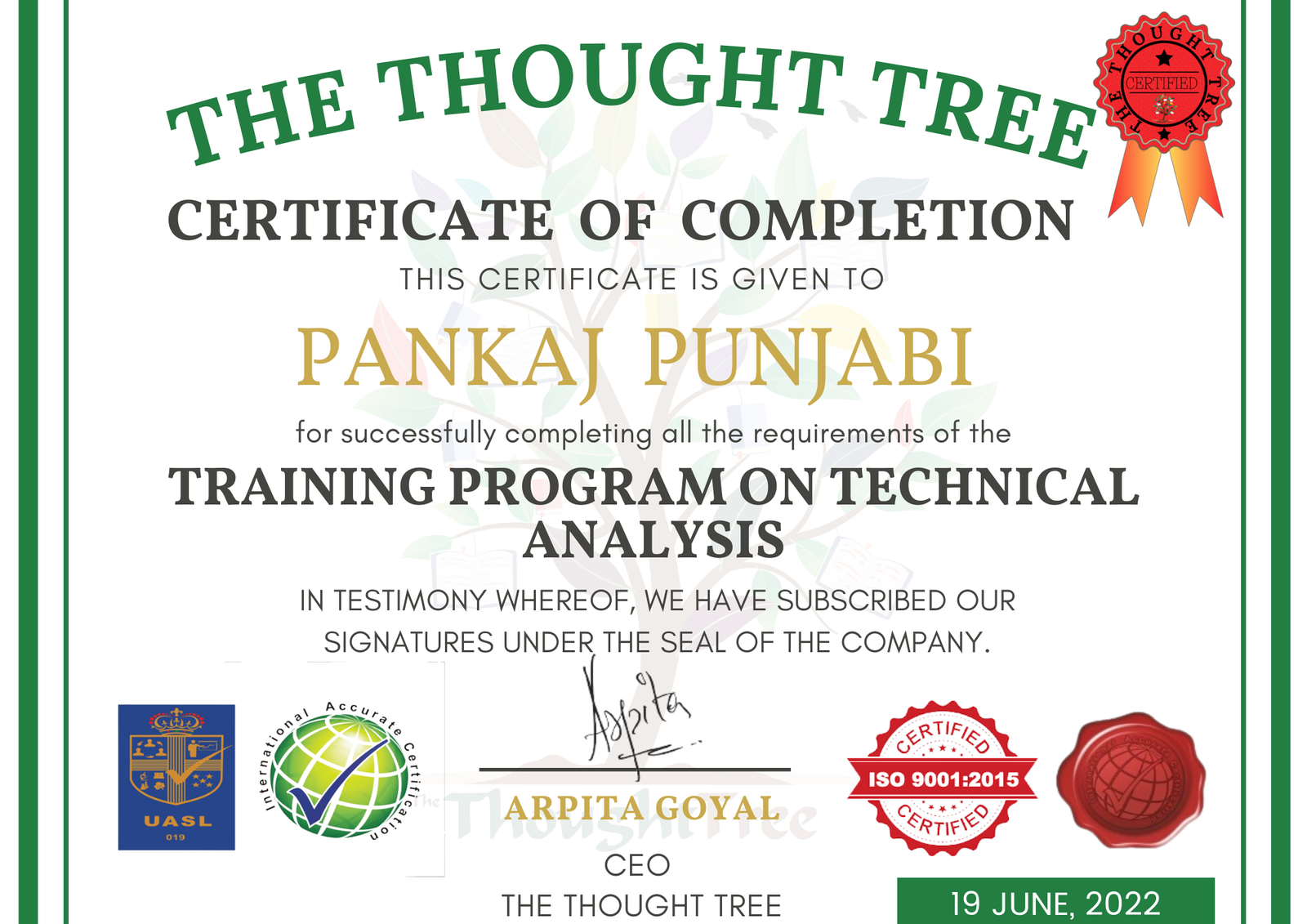

Certificate

Earn Your Certificate

The Thought Tree provides certifications after completing the Upskilling Courses. This will be proof that you have developed a skill working on projects and case studies. This will set you ahead of the competition.

Worldwide Recognised Certificate

The certificate provided by The Thought Tree is ISO certified. This certificate will be valid all over the world. You can share this certificate on Linkedin or your Resume to boost your authenticity.

Benefits of Certificates:

- Validation of Knowledge

- Increased Earning Power

- Competitive Advantage

- Improved reputation

- Boost Self-Confidence

- Respect from Peers

Course Curriculum

Introduction of technical analysis

Strengths and weaknesses of technical analysis

Dow theory

Candlestick pattern

Support resistance

Head and shoulders

Double top bottom

Gap theory

Wave theory

Indicator and oscillators

Moving average

Trading strategies

Risk management

Discipline

Commonly Asked Questions

Who provides the best technical analysis course?

The Thought Tree provides the best technical analysis course in Jaipur, Rajasthan, India.

Any beginner can join T3's technical analysis course. At T3, teachers are very experienced and start the course from basic knowledge and slowly increase their level of concepts according to their student's understanding.

In the course offered by The Thought Tree, students will learn the basics of technical analysis, risk management, candlestick pattern, advanced technical analysis strategies, indicator and oscillators, and many more. Both offline and online technical analysis course is available at T3.

How do I start learning technical analysis?

People interested in learning technical analysis can opt for the certified technical analysis course offered by The Thought Tree. T3 starts the course from basics so beginners can understand how it works.

Does Warren Buffett use technical analysis?

No. Warren Buffett does not use technical analysis for trading in the stock market.

Warren Buffett used to use technical analysis for investing many years ago, but he has switched to fundamental analysis as in fundamental analysis, he focuses on the company's financial trends like profits and debts.

Warren Buffett says that he had stopped using technical analysis for his analysis of stocks and investments as he noticed that technical analysis didn't work when he turned the chart upside down, and he didn't get a different result or answer.

What are the 4 basics of technical analysis?

Four basic principles of the technical analysis are given below:

1. Markets alternate between range expansion and range contraction: The two phases in which markets tend to exist are chopping back and forth in ranges or trending.

So, the thing here is that the trading tools or strategies traders use will work in one environment or phase and exactly gets the opposite or wrong in another environment or phase.

2. Trend Continuation Is More Likely Than Reversal: When a market is in a trend, the best bet of a trader at this moment is always on the continuation of the trend.

As traders who focus on counter-trend trading many a time get an emotional charge of being right and from catching the trend but this approach many times causes traders to miss the trends which provide really easy money.

3. Trends end in one of two ways which is a climax or rollover: The trends in the market end if the market just runs out of steam, if resistance begins to hold, and the market rolls over.

4. Momentum Precedes Price: Last but not least, this is one of the important principles of the market.

The same pattern which repeats itself over and over again in all time frames in the stock market is that it first moves in one direction, then take a pause and takes a smaller move in the opposite direction and then again another move in the original direction.

This principle says that when the market takes a sharp move, the price is likely to move to continue further in the same direction.

Why should I join the Technical Analysis Course?

If a person joins a Technical Analysis course and sincerely completes the course, then they will get a good insight into the best strategies and profitable technical patterns supported by any statistical analysis of the market.

Joining The Thought Tree for the technical analysis course will allow students to see and handle live trading and tools at their learning stage under the supervision of expert and experienced teachers.

The technical analysis course at T3 also offers a course completion certificate. So, after the course has been completed, the student will get a certificate as proof of the course and skills that the student has gained and will easily get a good post in the market by his or her skills.

Is it a good idea to learn technical analysis?

Yes, learning technical analysis is worth it. Technical analysis helps get good returns from the market and stops traders from making silly investment mistakes.

Technical analysis is not that complex to learn, understand and use in the market. It's not like only experts and professional traders can use and apply technical analysis in their trading. Anyone can learn and use technical analysis to trade and make money.

Most of the time, technical analysis works and gives traders a way to make money from trading but just using technical analysis is not enough to make money from trading. Traders need a proper understanding and strategy to trade with an edge.

How do I become a technical analyst?

To become a technical analyst, an individual needs to have at least a bachelor's degree in economics, mathematics, or finance, should have mastery of technical analysis software and should have a valid license.

Along with a degree in bachelor's you should also have at least three to five years of experience in technical analysis in the market.

Chartered Market Technician (CMT) certification will also help a lot to become a successful technical analyst. Interested individuals can also get certificates in technical analysis courses from The Thought Tree.

Who provides the best technical analysis course near me?

If you are from Jaipur, then The Thought Tree provides the best technical analysis course near you.

Which is the best online technical analysis course?

The Thought Tree provides the best online technical analysis course.

More About the Technical Analysis Course

What is Technical Analysis?

Technical Analysis uses charts, graphs, and trends in the market to determine or forecast any particular stock's outcome rather than studying any company's financial reports.

In a Professional Language

Technical analysis is a trading analysis tool used to evaluate the future value of investments and identify potential business paths by analyzing statistical trends or patterns gathered from doing business, such as price movements and volumes.

Unlike the other major tool – fundamental analysis, which aims to assess a security's value based on its financial reports or statements, technical analysis is all about studying the price and volume of the security. It is more inclined towards microscopic factors like the supply and demand of the share. Technical analysis is generally used to create short-term trading predictions from various charting tools.

A Brief History of Technical Analysis

This major form of technical analysis as it is today was instigated by Charles Dow, and Dow's Theory around the late 1800s formed its foundation. Today, technical analysis has evolved and considers hundreds of patterns and signals inferred from trends developed over decades of research.

Who Should Join the Technical Analysis Course at The Thought Tree?

- Bankers

- Traders & Investors

- Dealers, Sub-brokers, Relationship Managers, Asst. Relationship Managers, Professional Stock Broker, Investment Consultants, Portfolio & Fund Managers, Wealth & Treasury Managers, Researchers, etc.

- Those looking to pursue a career as an Analyst or a career in financial services

- MBA & BBA Students

- Anyone who wants a job

- 10+2, Students Pursuing B.A./ B.com. /B.Sc.

Why do Traders use Technical Analysis?

Traders are people who trade in the stock market daily. They profit from small movements in the price of security. They inject capital to get a good amount of return from the market. But they must do a good amount of research before getting into the game. Technical analysis is not wholesome research and is not foolproof, but it has advantages if you know how to read between the trends. To get in-depth knowledge of technical analysis, join our Technical Analysis Course.

Objectives of Technical Analysis

1. Price Forecasting

Technical analysts seek to predict the movement in the price of any instrument that is trading virtually and generally influenced by the forces of supply and demand, including securities like equity securities, debt securities, derivatives, and currency securities. Many view technical analysis simply as the study of supply and demand, and the forces shown in the movements in the market price of security prove so. Technical analysis is most commonly applied to price movements, but some analysts track numbers other than price, such as – volume, interest rates, bands, averages of stats, etc.

2. Relative Strength

There are tons of patterns and trends throughout the stock market that researchers have developed to aid trading with technical analysis. Technical analysts have also begun with numerous types of trading systems to help them predict price movements and trading based on the same. Few indicators mainly focus on recognizing the current market trend, considering the areas that support and areas that are resistant. In contrast, others focus on evaluating the strength of a trend and its potential or ability to continue. Basic and most-used technical indicators and chart patterns include line trends, RSIs, DMAs, and momentum indicators.

What are the Types of Technical Analysis?

The more accurate question should be – What are the types of Technical Analysis charts used?

Gladly explained here! There are 3 main types of charts used in technical analysis – candlestick, bar, and line charts. All 3 represent the same data but are visually different and have different ways of displaying the info.

A candlestick is a way to represent data about the movement within the price of an asset. Candlestick charts are among the foremost tools of technical analysis, allowing traders and investors to predict price info effectively and from some price bars.

Again, Bar patterns are short-term patterns used for timing the trades and identifying rational stop-loss orders. Bar patterns are almost like candlestick patterns, and every short-term trader knows this fact.

It should be noted that bar patterns play an important role once they appear during a strong bullish or bearish trend near the tip of the trend. Like candlestick trends, bar patterns are short-term and may imply a reversal of available prices in another direction.

Bar patterns may be employed in any period of time, be it 5 minutes, 15 minutes, hourly, daily, weekly, monthly, etc. The longer the amount, the more important the bar patterns are in relevance to the scale of the following movement.

A line chart is a summarized representation of the historical price trend of an asset that connects a series of observation points with a solid line. This is the foremost basic chart utilized in finance and typically represents a stock's closing prices over time. These charts may be used for any fundamental measure, but usually, they use daily price changes.

A line chart gives traders a transparent view of how a stock's price has changed over any specific period of time. Since line charts typically only display closing prices, they reduce unnecessary info at less critical times of the trading day, like open prices, high-lows, and so on. Line charts are fashionable with investors and traders because closing prices are quite common data associated with a stock.

How to do Technical Analysis?

There are two different approaches to technical analysis: the top-down approach and the bottom-up approach. Short-term traders take a top-down approach, and long-term investors take a bottom-up approach. To get started with technical analysis, follow these 5 essential steps.

- Begin with choosing or developing your trading system or strategy.

- Choose the securities you want to work with, according to step 1.

- Open your brokerage account with a brokerage that supports your securities and provides the chosen technical analysis tools.

- Track your securities with different levels of tools and functionalities.

- Using additional tools or software will help.

To learn technical analysis in detail, the suggestion is that you enrol in our Technical Analysis Course.

Difference Between Technical Analysis and Fundamental Analysis

| Technical Analysis | Fundamental Analysis |

| It studies the general behavior of any company in the market according to the graphs and patterns. | It studies the financials of the company and the market conditions in general. |

| Begins with reading charts and graphs. | Begins with analysis of financial reports and conditions of the economy. |

| Aims to analyze the general market psychology and predict roughly where the stock is headed. | Aims to analyze the company and find out its intrinsic value, which helps identify whether the company is undervalued or overvalued. |

| The basic analysis of where the stock is headed will not take long since it is a short-term analysis tool. | The process is long, and the results may take a long to show in the real market. The intrinsic value can take a long time to appear in the market. |

| Technicals are the ones who seek to earn profits quickly. | Fundamentalists are in it for the long haul and reap benefits after a long time. |

Best Books for Technical Analysis

Here are some books on technical analysis

- Getting Started in Technical Analysis (written by Jack Schwager).

- Technical Analysis Explained by Martin Pring.

- How to Make Money in Stocks (written by William O'Neil).

- Japanese Candlestick Charting Techniques (written by Steve Nison).